How to Use Trading Signals for Consistent Profits in Volatile Markets

Table of Contents

Volatility is a trader’s double-edged sword. On one hand, it opens doors to massive profit potential. On the other, it poses serious risk if not handled with precision and discipline. If you've ever found yourself reacting emotionally to rapid market moves or second-guessing your trades, you're not alone.

That's where trading signals come in — a game-changing solution that removes guesswork and enables consistent profits, even in the most unpredictable market environments.

In this guide, you’ll learn how to use trading signals for consistent profits — not just the theory, but practical steps, real-life strategies, and proven tools.

We'll also explore why more traders are turning to AI-powered solutions like VIP Indicators for reliable, real-time trade alerts with up to 93% accuracy.

What Are Trading Signals?

Trading signals are real-time indicators or alerts that suggest buying or selling an asset based on technical analysis, algorithmic patterns, or market sentiment. They aim to simplify the decision-making process by highlighting high-probability trade opportunities.

Types of Trading Signals

- Manual signals: Generated by human analysts based on chart analysis.

- Automated signals: Issued by trading bots or algorithms.

- AI-powered signals: Leveraging machine learning to adapt and evolve with market patterns.

Real-Life Scenario: Imagine you’re a day trader juggling multiple charts. An AI-generated signal alerts you to a sudden bullish breakout on the EUR/USD pair. You enter the trade with confidence and exit with a 15% profit — all without staring at your screen for hours.

Why Volatile Markets Require Smart Signal Strategies?

Volatility = Opportunity + Risk

Volatility fuels big price movements. However, trading on emotion or hunches can wipe out gains quickly. You need a system that cuts through the noise — this is where trading signals shine.

Signals Help You:

- Avoid emotional trading

- Time entries and exits better

- Spot trends early

- Improve risk/reward ratios

Expert Insight: According to a study published in the Journal of Financial Markets, traders using structured signal-based strategies tend to outperform discretionary traders in volatile conditions due to reduced emotional interference.

How to Use Trading Signals for Consistent Profits?

Achieving consistency in profits isn’t about chasing every signal — it’s about using the right signals the right way, in the right context.

Let’s explore how to effectively use trading signals so they become part of a system, not just random alerts.

🧭 Step 1: Choose a High-Accuracy Signal Provider

Not all signal services are created equal. Choosing the right provider is the foundation for consistent performance.

What to Look For:

- Accuracy rate of 85% or higher (VIP Indicators offers up to 93%)

- Real-time delivery via email, app, or TradingView

- Transparent track record or live results

- Compatibility with your preferred asset class (Forex, Crypto, Stocks)

- Ease of use — especially for beginner traders

✅ Real-World Tip: Many traders lose money not because signals are bad, but because they use free, low-quality ones. Investing in a premium solution like VIP Indicators saves time and helps prevent unnecessary losses.

📊 Step 2: Understand the Market Context Before Acting

No matter how good the signal, context is king. Even a bullish signal can fail if it's against the broader market trend or released during a volatile news event.

How to Filter:

- Check the trend on a higher time frame.

- Avoid trading right before or during major economic announcements.

- Look for confluence (e.g., trendline breaks, Fibonacci levels, moving average crossovers).

Example: Let’s say VIP Indicators flashes a “Buy” signal on EUR/USD during an uptrend, and the price just bounced off a 200 EMA — that’s a strong, confluence-backed trade. But if the signal appears during a flat, choppy market — it’s better to skip.

⏳ Step 3: Align Signals With Your Trading Style

The best traders don’t chase every alert — they know which signals align with their strategy and personality.

Matching Style to Signal:

- Scalpers: Look for short-term momentum signals on 1-5 minute charts.

- Day Traders: Use 15-min to 1-hr signals that capture intraday volatility.

- Swing Traders: Rely on 4-hr to daily signals that reflect larger market structure.

- Position Traders: Use signals aligned with weekly trends or fundamentals.

🎯 Case Study: Sarah, a part-time swing trader, only executes trades when VIP Indicators shows a reversal signal that aligns with RSI divergence and a key support level.

This selective approach has helped her maintain a consistent 3:1 reward-to-risk ratio.

🧮 Step 4: Manage Your Risk — Always

Even with the most accurate signals, no system is infallible. That’s why smart risk management is the safety net every trader needs.

Risk Management Rules:

- Never risk more than 1-2% of your capital on a single trade.

- Use a stop-loss based on volatility or technical structure.

- Set realistic take-profit targets — ideally at least 2x your risk.

- Avoid revenge trading or doubling up to recover a loss.

📌 Pro Insight: VIP Indicators includes take-profit and stop-loss zones in each signal. This helps traders with risk management built directly into the alert, reducing emotion and guesswork.

📘 Step 5: Keep a Trading Journal and Review Regularly

Consistent profits come from feedback and refinement. A trading journal is your best friend in spotting what works — and what doesn’t.

What to Track:

- The exact signal received (buy/sell, asset, time)

- Your entry and exit

- Whether the trade followed your plan

- What you felt during the trade (emotions matter)

- Outcome (profit/loss) and any lessons learned

🧠 Growth Tip: Review your trades weekly. You’ll start seeing patterns — like which signal types perform best, which time frames suit you, or which setups to avoid altogether.

🔄 Step 6: Build a Repeatable Routine

Consistency is a byproduct of discipline and structure.

Sample Daily Routine for a Signal-Based Trader:

- Pre-market check: Look at economic calendar and news.

- Chart scan: Review assets on your watchlist for setups.

- Set alerts: Use tools like VIP Indicators to automate signal detection.

- Execute trades: Only act when the signal aligns with your criteria.

- End-of-day review: Journal your trades and update your metrics.

💡 Efficiency Tip: Tools like VIP Indicators automate most of this by alerting you only when your entry criteria are met. That means less screen time, more precision.

Using these trading signals for consistent profits isn’t about magic. It’s about:

- Choosing a high-quality, proven signal provider

- Filtering signals with market context

- Aligning them with your trading style

- Practicing strict risk management

- Tracking and optimizing through a journal

- Sticking to a repeatable routine

When done right, signals transform from mere alerts into powerful tools for steady, confident decision-making.

📈 Ready to streamline your trading with AI-powered precision?

👉 Get started with VIP Indicators today

Common Mistakes Traders Make with Signals

Trading signals can be powerful tools when used correctly — but like any tool, misuse can lead to losses, frustration, and a false sense of security.

Understanding the most common mistakes traders make when using trading signals can help you avoid pitfalls and unlock consistent success.

Let’s break them down one by one:

❌ 1. Blindly Following Every Signal

This is perhaps the most dangerous habit — treating signals as infallible instructions rather than strategic suggestions.

Why It Happens:

- Beginners often assume signals are "guaranteed wins"

- Lack of confidence in one’s own analysis

- FOMO (Fear of Missing Out) drives impulsive trades

The Fix:

Use signals as a starting point — not a standalone decision. Ask yourself:

- Does this signal align with the current trend?

- Is there supporting evidence (e.g., price action, support/resistance)?

- Is it the right time of day to trade?

📌 Pro Insight: Smart traders use signals like a GPS. It suggests a route, but you still need to check the traffic. VIP Indicators, for example, highlights high-probability setups, but the final decision should come with your own context check.

🚀 2. Overtrading Due to Too Many Signals

More signals don’t always mean more profits. In fact, jumping into too many trades can lead to decision fatigue, capital drawdowns, and burnout.

Signs of Overtrading:

- Taking trades outside of your trading hours or plan

- Feeling the need to be “always in a trade”

- Risking too much in hopes of making quick gains

The Fix:

- Filter for quality over quantity

- Focus on signals that meet multiple conditions (trend + breakout + volume spike)

- Set a daily or weekly trade limit based on your risk plan

💡 Real-Life Scenario: Marcus, a part-time trader, was acting on every signal from three different providers. His win rate dropped and stress levels increased. After switching to just one reliable provider (VIP Indicators) and limiting trades to 2 per day, his consistency improved dramatically.

⚠️ 3. Ignoring Risk Management

No matter how accurate the signal, it’s not foolproof. Skipping proper stop-loss placement or over-leveraging can erase weeks of gains with one bad trade.

Common Risk Mistakes:

- Trading without a stop-loss

- Risking more than 2–3% per trade

- Letting losses run and cutting winners early

The Fix:

- Always use pre-defined stop-loss and take-profit levels

- Follow the 1:2 or better risk-reward ratio

- Treat risk like rent — it must be paid to stay in the game

🎯 Smart Signal Tip: Many premium tools like VIP Indicators come with suggested stop-loss and TP levels, which help automate solid risk management.

🧪 4. Not Testing the Signal System First

Jumping into live trades without testing a new signal provider is like driving a race car without brakes.

The Risk:

- You don’t understand how the signals work

- You can’t recognize which signals are more reliable

- You haven’t built trust in the system

The Fix:

- Backtest signals on historical data

- Use demo or paper trading to understand how they behave in real time

- Only move to live trading once you’ve proven consistent profitability

📊 Pro Tip: Backtest at least 50–100 signals before committing real money. Many users of VIP Indicators report a clearer edge once they’ve “learned the language” of the system in demo mode.

🔄 5. Changing Strategies Too Often

Many traders jump between systems, signal providers, and styles without giving any one of them enough time to prove themselves.

Why It’s Dangerous:

- You never build mastery in one method

- Inconsistent application = inconsistent results

- You lose trust in the process, increasing emotional trades

The Fix:

- Stick to one signal system for at least 30–60 days

- Track every trade in a journal and analyze your performance weekly

- Only make adjustments based on data, not emotion

🧠 Long-Term Thinking: Trading isn’t about the next signal — it’s about the next 100. Commit to a proven system like VIP Indicators and let compound discipline take effect.

🧩 6. Relying on Incomplete or Free Signal Services

It’s tempting to follow free Telegram groups or social media signals, but many of them:

- Lack transparency

- Don’t explain why a trade was recommended

- Don’t include risk parameters

- May be run by unverified individuals or affiliates looking for copy trades

The Fix:

- Choose signal providers that offer:

- Verified results

- Explanations or logic behind each signal

- Support and community access

- Avoid anonymous sources with no accountability

🛡️ Safety Tip: VIP Indicators is a fully-transparent tool with visual chart signals, real-time accuracy, and user guidance built-in. You know what you’re getting — and why.

📉 7. Letting Emotions Override the Signal

Signals are logical — humans are emotional. The moment you override a system due to fear, greed, or revenge, the signal’s power is lost.

Examples of Emotion-Driven Mistakes:

- Exiting a trade early because the market “looked scary”

- Doubling down to “make back” a losing trade

- Hesitating to enter a winning setup due to previous loss

The Fix:

- Trust your plan — not your feelings

- Use predefined entry, stop-loss, and take-profit orders

- Take breaks between trades to clear your mind

🧘♂️ Discipline Hack: Use tools that reduce the need for real-time decisions. VIP Indicators gives crystal-clear chart visuals and alerts so you can trade with logic, not fear.

How VIP Indicators Can Help You Trade Smarter

In a market where milliseconds can make or break a trade, VIP Indicators has emerged as a powerful AI-driven signal tool trusted by thousands of traders around the world.

Whether you're a complete beginner or a seasoned market participant, VIP Indicators helps remove the noise, simplify decisions, and sharpen your trading edge — all in real time.

Let’s take a closer look at how this tool works and why it's becoming a favorite among traders looking to build consistent profits in volatile markets.

🚀 Key Features That Make VIP Indicators a Game-Changer

Let’s break down what you get when you use VIP Indicators:

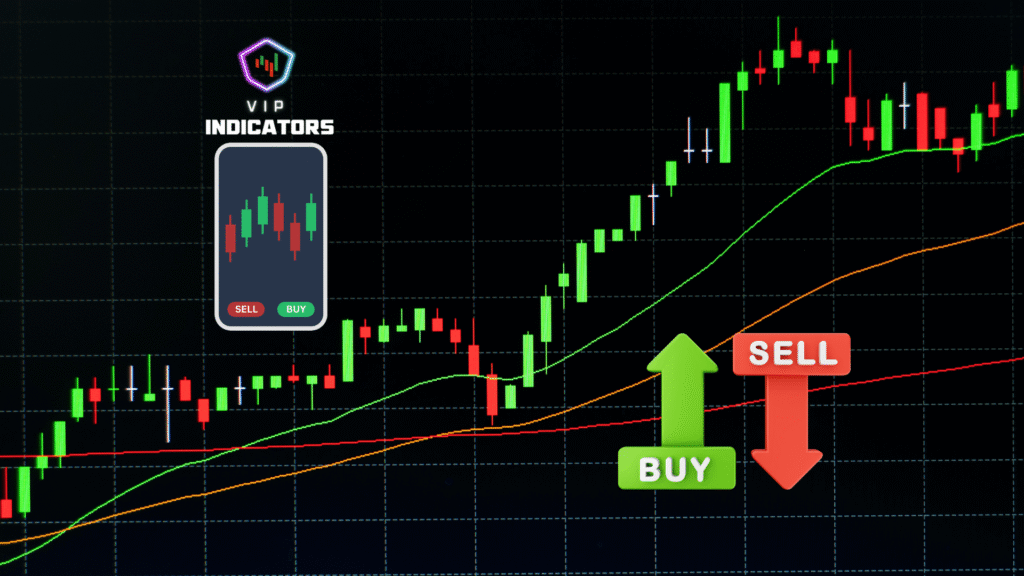

✅ Real-Time Buy/Sell Signals

No delays. No second-guessing. You receive live, on-screen signals telling you exactly when to enter and exit. This reduces emotional errors and increases execution precision.

Example: If you’re trading Bitcoin on the 1-hour chart, VIP Indicators will flash a large green "BUY" or red "SELL" signal directly on your chart — giving you visual clarity when the market meets predefined conditions.

✅ AI-Powered Accuracy (Up to 93%)

The core of VIP Indicators is built on artificial intelligence that constantly learns from historical data and live price action. This allows the system to adapt to various market conditions and deliver highly accurate signals even during volatility.

💡 Use Case: A trader using VIP Indicators during a volatile NFP (Non-Farm Payroll) news release avoids premature entries because the AI filters out low-probability setups — waiting only for confirmation before signaling.

✅ Compatible With All Major Assets

You can use VIP Indicators across:

- Forex (EUR/USD, GBP/JPY, etc.)

- Crypto (Bitcoin, Ethereum, altcoins)

- Stocks (Tesla, Apple, etc.)

- Indices (S&P 500, Nasdaq)

- Commodities (Gold, Oil)

This cross-market functionality makes it ideal for diversifying strategies and maximizing opportunity.

✅ Works on Any Time Frame

From scalpers working 1-minute charts to swing traders analyzing daily setups, VIP Indicators supports:

- 1m, 5m, 15m

- 1H, 4H, Daily

- Weekly views for position traders

📊 Trader Insight: Swing trader Amanda prefers the 4H chart for her setups. By focusing only on VIP Indicator signals that align with support/resistance zones, she’s maintained a 78% win rate over the past 3 months.

✅ Visual Simplicity for Faster Decisions

No complex charts or confusing data. The system shows simple arrows, color-coded zones, and labels that tell you when to act. This helps both beginners and advanced traders save time and reduce errors.

🖥️ Ease-of-Use Bonus: You don’t need to install complicated software. VIP Indicators runs directly on TradingView — a free charting platform that works on any device.

✅ Includes Risk Management Zones

Each signal often comes with built-in stop-loss and take-profit suggestions, helping you trade with predefined risk-reward ratios — a major reason why traders stay consistent.

🛡️ Risk Tip: Many users report better trading discipline once they follow VIP Indicator’s built-in SL/TP guidance, helping them avoid premature exits or letting losses run.

Real-Life Results from VIP Indicator Users

Let’s explore how actual traders are using VIP Indicators to improve their performance:

- Nathan (Forex Day Trader):

“I was averaging 6 hours a day on charts. With VIP Indicators, I just wait for alerts and verify the setup. I now spend less time trading and make better decisions.” - Lisa (Crypto Swing Trader):

“The visual signals helped me avoid emotional entries. I now have clear confidence when I place trades.” - Sean (Beginner Trader):

“I had no idea what I was doing before. VIP Indicators helped me understand the markets faster than any course I paid for.”

🧠 Why VIP Indicators Is Ideal for All Skill Levels

For Beginners:

- No prior experience needed

- Step-by-step tutorials included

- Clear, chart-based signals — no jargon

For Experienced Traders:

- Cut your chart time in half

- Boost precision with AI-backed entries

- Layer onto existing strategies as confirmation

📌 Bonus: Many pro traders use VIP Indicators as a second layer of confirmation before entering large positions — adding conviction and accuracy to their trades.

Getting started is simple:

- Sign up at https://vipindicatorss.com/get

- Connect the indicator to your TradingView account

- Open any chart — and start receiving real-time buy/sell alerts

- Trade with more clarity, confidence, and consistency

There’s no need to spend years learning to trade when tools like this accelerate your growth from day one.

Mastering the Signal Game

Volatile markets aren’t something to fear — they’re an opportunity waiting to be harnessed. With the right trading signals, solid risk management, and a commitment to learning, consistent profits are within reach.

By combining your own trading edge with high-accuracy tools like VIP Indicators, you stack the odds in your favor — and remove the emotion, stress, and confusion from trading.

If you're tired of:

- Overanalyzing charts

- Getting in too late

- Missing high-probability trades

It’s time to let AI do the heavy lifting.

👉 Get Access to VIP Indicators and experience the future of trading.

You’ll get access to a plug-and-play system that delivers real-time, high-accuracy buy and sell signals so you can finally trade with clarity and confidence.

FAQs

What are trading signals?

Trading signals are alerts or indicators that suggest a good time to buy or sell an asset based on technical, fundamental, or AI-based analysis.

Can trading signals help me make consistent profits?

Yes, especially if you follow a disciplined strategy and use reliable signals like VIP Indicators.

How accurate are trading signals?

Accuracy varies. AI-powered systems like VIP Indicators claim up to 93% accuracy when used correctly.

Are free signal services worth using?

Free signals can be hit or miss. For consistent results, a premium, tested solution is recommended.

Is it safe to follow signals without analysis?

You should always understand why a signal is triggered. Combine it with your trading plan for best results.

What markets can I use trading signals for?

Forex, crypto, stocks, commodities — signals work across multiple markets.

Do I need prior experience to use signal tools?

Not necessarily. Tools like VIP Indicators are beginner-friendly and come with tutorials.

How fast do I need to act on a signal?

In volatile markets, speed is crucial. Real-time alerts are key.

Can trading signals work with my broker?

Most signal tools work with major platforms like TradingView, which integrates with many brokers.

10. Where can I get reliable trading signals?

Start with VIP Indicators — it’s trusted by thousands of traders for a reason.